Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights. Upgrade to get all 30 charts.

1. Global Composite PMI. "The rate of global economic growth hit a 12-month high in May."

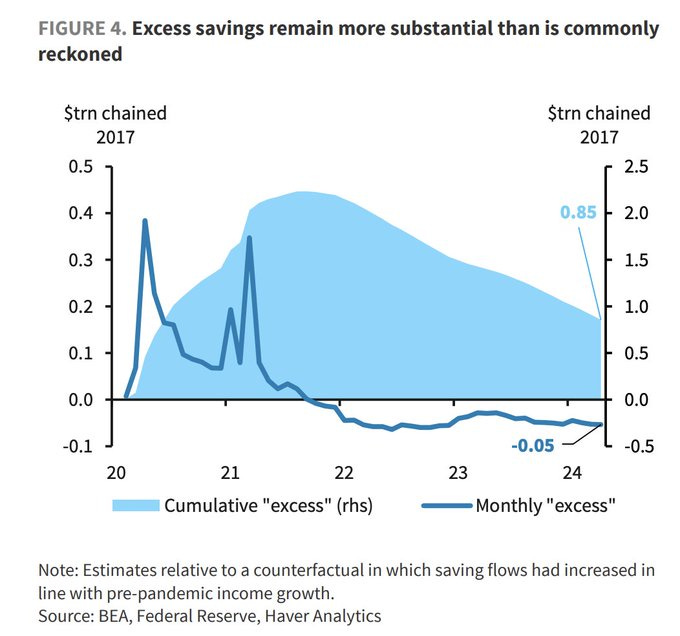

2. Excess savings. "Barclays still tracking 'excess savings,' estimates there's $850 billion outstanding that is only getting run down at rate of $50 billion/month."

3. Earnings vs. valuation. "The consensus 12-month earnings estimate is growing at 12% and the 18-month estimate is growing at 17% ... [which] is allowing the P/E-multiple to come down somewhat ... the forward P/E ratio is now making a lower high even though the S&P 500 price index is making a higher high."

4. FOMO. "The fear of missing out on upside gains (FOMO) exceeding the fear of downside may seem irrational. But it’s happening. Since 2023 US equities have exhibited higher volatility on days equities are up than on days they are down."

5. Concentration vs. returns. “The market tends to produce returns above the historical average in periods when concentration is rising and returns below the average when concentration is falling.”