Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights. Upgrade to get all 30 charts.

As a reminder, there are 15 days left to lock in your first year of full access to Daily Chartbook at the discounted launch rate:

1. Wage Tracker. “If posted wages continue to slow down at roughly the rate they have for the past three months, the Indeed Wage Tracker will return to its pre-pandemic pace before the middle of next year.”

2. GS Financial Conditions Index. "Yesterday’s US FCI easing of -23bps was historic…it ranks as the 30th biggest 1d easing event going back to 1990."

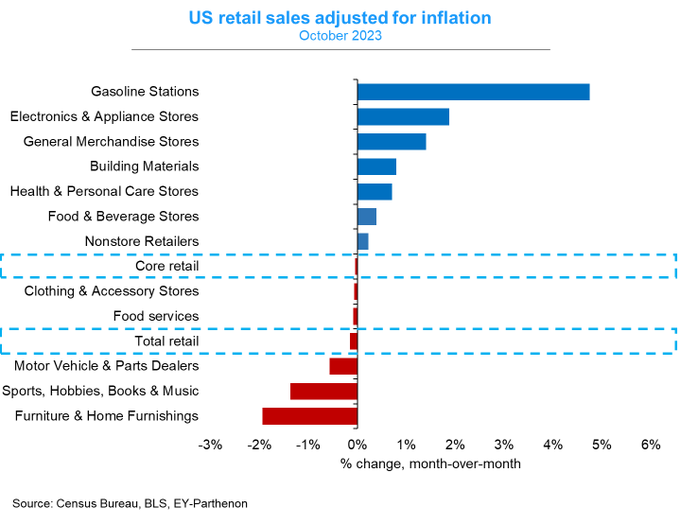

3. Retail sales (II). "The inflation-adjusted picture for retail sales shows that consumers are not retrenching, but instead being more judicious with their dollars."

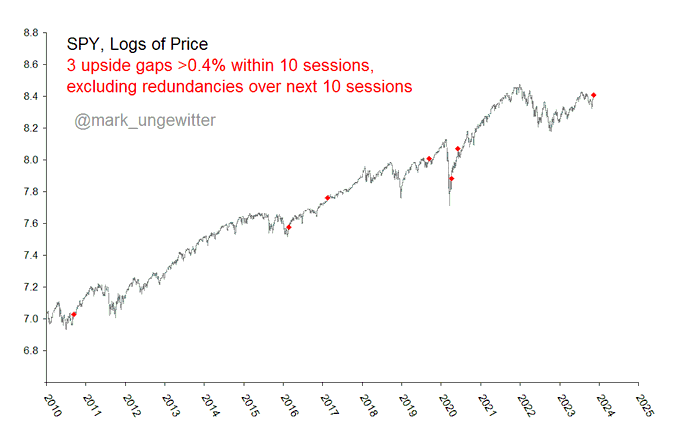

4. Upside gaps. "Successive upside gaps comparable to the current case have generated bullish follow-through since 2010."

5. Value vs. Growth. "Value is rising roughly in line with US real yields across the world. Only the US is bucking the trend."